As outlined by Us all federal government law, bank scam is purposefully committing as well as wanting to spend some dishonest scheme in order to...

1. Defraud a monetary company; or

Two. Receive money, possessions, breaks, etc., underneath the handle or perhaps child custody of your financial institution as well as lender

via scam, misrepresentation, or even false guarantees.

The maximum punishment regarding lender fraudulence will be $1 trillion. The absolute maximum physical punishment is actually 3 decades. The court may possibly mete out and about either or perhaps each.

Definitely not the Bank

Even though the criminal offenses is called "bank fraud", it's actually a error to visualize that the legislation does apply simply to fraudulence in opposition to banking institutions or loan companies. The second subsection from the legislations also includes money which are in the "control as well as custody" from the financial institution. And so the financial institution doesn't have to be your loss in the fraudulent work.

For example, a new criminal engages in fraud that will ends in subjects emailing your pet assessments, which he cashes with a bank along with pockets. The actual criminal could possibly be arrested for lender fraudulence. Developing inspections (or perhaps the recognition with them) you may also have at the mercy of fees regarding standard bank scams.

Creating Bogus Assertions

Federal government prosecutors often cost perpetrators associated with bank scam together with producing untrue phrases in order to banking institutions. Producing these kinds of fake statements is described as

One particular. Knowingly making a bogus affirmation, or overvaluing property

2. To guide in any respect

3. The action of a lender or traditional bank.

This is any federal criminal offenses as well as has precisely the same highest fees and penalties while bank fraud.

Specialized Financial institution Scams

You can find seven lender scam plans commonly perpetrated through folks working in just a lender. They are

One particular. Demand draft scam : Usually perpetrated by a damaged bank employee who is really a demand set up you'll pay in a few remote location without having debiting just about any accounts. It's banked on the remote control part.

Two. Creating or perhaps generating deceptive documents -- Usually completed to hide any thievery

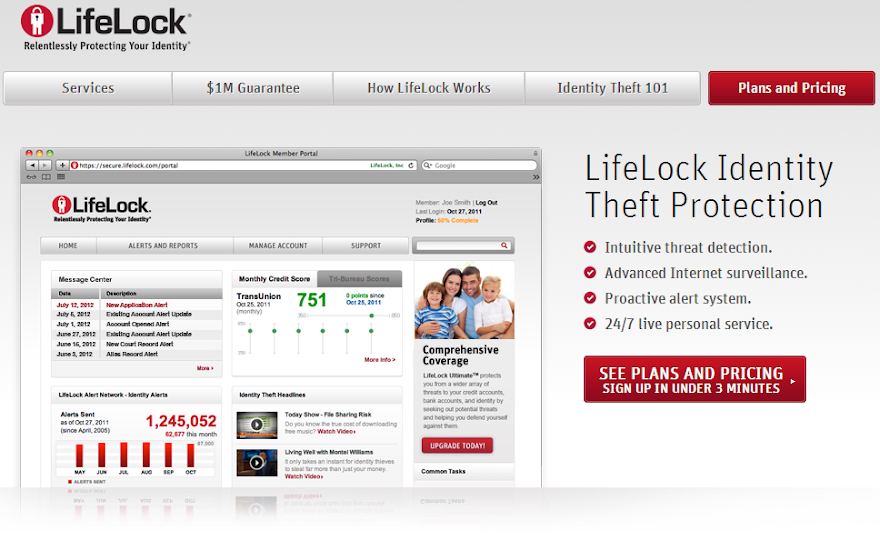

Several. Identity theft -- Any tainted bank employee may give individual data to a identification burglar whom might receive credit history beneath the victim's brand.

Four. Making deceitful loans -- The phony organization a treadmill in which quickly declares a bankruptcy proceeding removes credit using the collusion of the damaged standard bank policeman.

5. Dodgy buying and selling : Perpetrated with a extremely placed financial institution professional, dodgy buying and selling entails while using the bank's funds to create speculative investments to generate a rapid revenue. If your rumours pays off, the actual criminal trader wallets the gains. When losses arrive 1 to another, any scandal may well ensue, and/or the lender may well collapse.

6. Without insurance deposits -- Some finance institutions are certainly not accredited to use and so are consequently without being insured (as well as the other way around). As an illustration, within 2004, a new Washington financial institution called Run after Have confidence in Lender was found to have absolutely no license after it had been subjected to always be not related in any respect for you to Fresh York's Follow Ny Standard bank.

7. Line scam : Banks use wire cpa networks to work among on their own. Cable exchanges are generally extremely hard in order to reverse and are as a result at risk of virus ridden associates.

Outsider Lender Scams

Right after can be a dozens of common schemes perpetrated through people who are generally beyond your financial institution, but nevertheless charged with standard bank fraud:

1. Sales scams

Only two. Booster-style assessments, in which un-cleared inspections are credited to enhance a new credit score balance

Several. Examine kiting, where income that's on the road (i.elizabeth., nonexistent) will be ripped off

Four. Duplicating or perhaps skimming card files, copying permanent magnetic red stripe details away the minute card regarding copying

A few. Forgery as well as changing checks

Half a dozen. Fraudulent loan requests

6. Identity theft

Eight. Net fraudulence

Nine. Income washing

12. Prime lender fraud

12. Robbing inspections

12. Stealing payment cards

Canadian Identity Theft Statistics 2013